HOME

Proof of Concept

ANZ and Westpac have completed a trial of distributed ledger technology for the bank guarantee process used in commercial property leasing

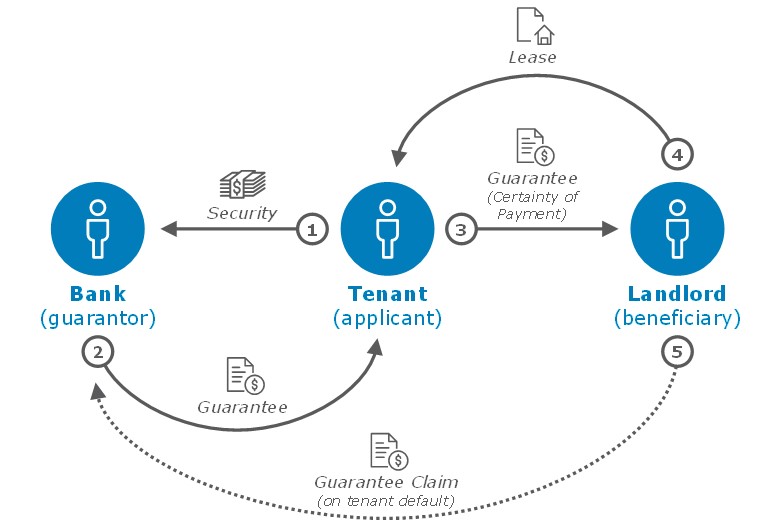

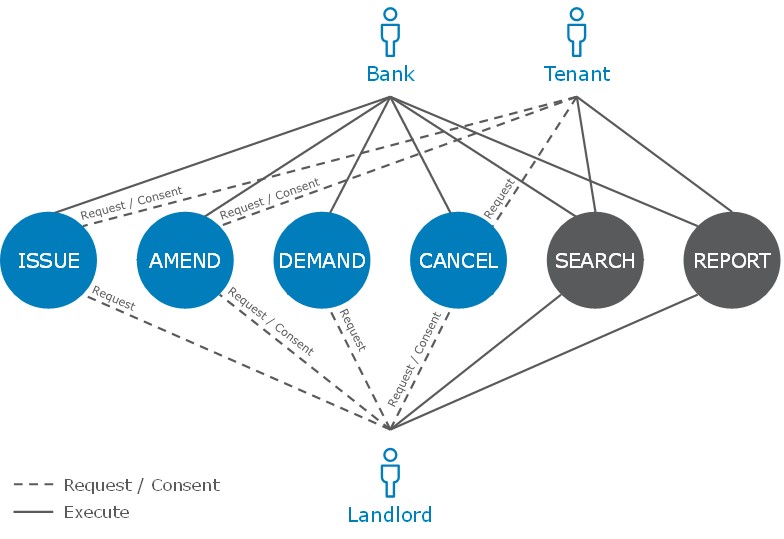

Run with IBM and Westfield shopping centre operator Scentre Group, the proof-of-concept “has the potential to shift the issuance of bank guarantees from a manual, paper-based model into the digital era, and in doing so, lift efficiency for all parties involved,” the companies said in a whitepaper, released today.

In addition to eliminating the need for physical document management, the trial also overcame other inefficiencies, including the tracking and reporting of a guarantee’s status through multiple changes, the group said.

“This is about removing the cost of fraud, error and operational risk that will continue as long as bank guarantees remain paper-based and manually issued,” said Andrew McDonald, general manager corporate and institutional banking at Westpac

Mark Bloom, Chief Financial Officer at Scentre Group, said an update of the guarantees process was ‘long overdue’.

“With approximately 11,500 retailers across Australia and New Zealand, who use guarantees to support rental obligations, manual tracking of guarantees has been an extremely cumbersome and labour intensive process,” he added.

The trial used core technology from Hyperledger – which ANZ and IBM are founding members and continuing supporters of – specifically the Hyperledger Fabric V1.0 framework, hosted by The Linux Foundation.

The group’s proof-of-concept could be transferable “to a broader guarantees context”, they said. A plan is now underway to build a shared solution with the rest of the industry, and to invite other organisations to participate in a larger pilot, ANZ said in a statement.

‘Helping clients avoid becoming corporate dodos’: IBM’s Chris Howard

“However, this move cannot be done in isolation. The changes required are pervasive and will require close collaboration between competitors, regulators, consumers, technologists, and the legal community in order to achieve a suitable solution,” the whitepaper states.

ANZ’s general manager wholesale digital, digital banking Nigel Dobson said the proof of concept has the potential for ‘industry-wide adoption.

“We have been keen to avoid the hype surrounding blockchain and distributed ledger technologies, and instead focused on practical and deliverable use cases,” he said.

“This proof of concept demonstrates how we can collaborate with our partners to develop a digital solution for customers, which also has the potential for industry-wide adoption.”

IT security concerns reach new high

Westpac and ANZ have been exploring the potential of distributed ledger technology for some time.

Westpac is a member of the R3 consortium of global financial institutions, which researches blockchain database usage in the financial system. In 2015 it began using Ripple Labs' peer-to-peer, distributed payments network to quickly transfer payments between subsidiaries.

It began using Ripple to settle and clear payments the same day, and as a low cost means to make low-value international payments.

It is also the largest investor in bitcoin wallet and exchange service, Coinbase.

Blockchain will have profound effect on economy, says Data61 study

Last year ANZ delivered a distributed ledger platform prototype with US bank Wells Fargo for correspondent banking payment reconciliation and settlement.

Read more: Aussie blockchain association launches

tre Groupdistributed ledger technologyhyperledger

IT security concerns reach new high

Westpac and ANZ have been exploring the potential of distributed ledger technology for some time.

Westpac is a member of the R3 consortium of global financial institutions, which researches blockchain database usage in the financial system. In 2015 it began using Ripple Labs' peer-to-peer, distributed payments network to quickly transfer payments between subsidiaries.

It began using Ripple to settle and clear payments the same day, and as a low cost means to make low-value international payments.

It is also the largest investor in bitcoin wallet and exchange service, Coinbase.

Blockchain will have profound effect on economy, says Data61 study

Last year ANZ delivered a distributed ledger platform prototype with US bank Wells Fargo for correspondent banking payment reconciliation and settlement.

Read more: Aussie blockchain association launches

tre Groupdistributed ledger technologyhyperledger